Orders per year

Cin7 customers

Gross merchandise value

Connected Inventory Performance makes it easy for product businesses to reach customers wherever they buy.

See how Connected Inventory Performance worksTouchless traceability, from supplier to customer (and everything in between).

There are two paths towards Connected Inventory Performance:

Core comes with everything you need to grow a world-class inventory operation, right out-of-the-box (and integrates seamlessly with whatever’s in your tech stack).

Omni is better for custom configuration and integration requirements for native 3PL fulfillment and selling through EDI retailers.

Maybe you want to build an efficient, automated, error-free inventory operation from the ground up.

Maybe you want to increase your profitability and reach new channels and markets.

Maybe you want to leave inventory burnout behind and get back to growing your business.

Wherever you’re at in your inventory journey, we can help. Take a look at our Connected Inventory Performance primer to see where to start.

Read more

Read more

Austicks has been manufacturing ice cream sticks since the 1980s. In that time, Austicks has grown to become Australasia’s largest supplier of ice cream sticks, supplying most of New Zealand, Australia and the South Pacific with around 725 million food-grade ice cream sticks annually.

Read more

Read more

Black Seal is all about riding great bikes with amazing friends and sharing unforgettable experiences.

Read more

Read more

As this London-based company expanded to the US, they turned to Cin7 to stay on top of inventory for new, fast-growing channels

Read more

Read more

Childsmart grew by selling children’s products to retailers face-to-face. When their market moved online, Childsmart turned to Cin7 to move with it and thrive.

Read more

Read more

As the exclusive distributor of Artphere briefcases in the US, Dagga Sous relies on Cin7 to keep its stock in order while delivering superior customer service.

Read more

Read more

Dean Davidson’s jewelry designs have won broad consumer acclaim. Cin7 gave them inventory visibility and took away overhead so they could keep growing.

Read more

Read more

It didn’t take an inventory disaster for this Melbourne-area distributor to sign up with Cin7. Accurate tracking of research equipment was a must for Decode Science from the start.

Read more

Read more

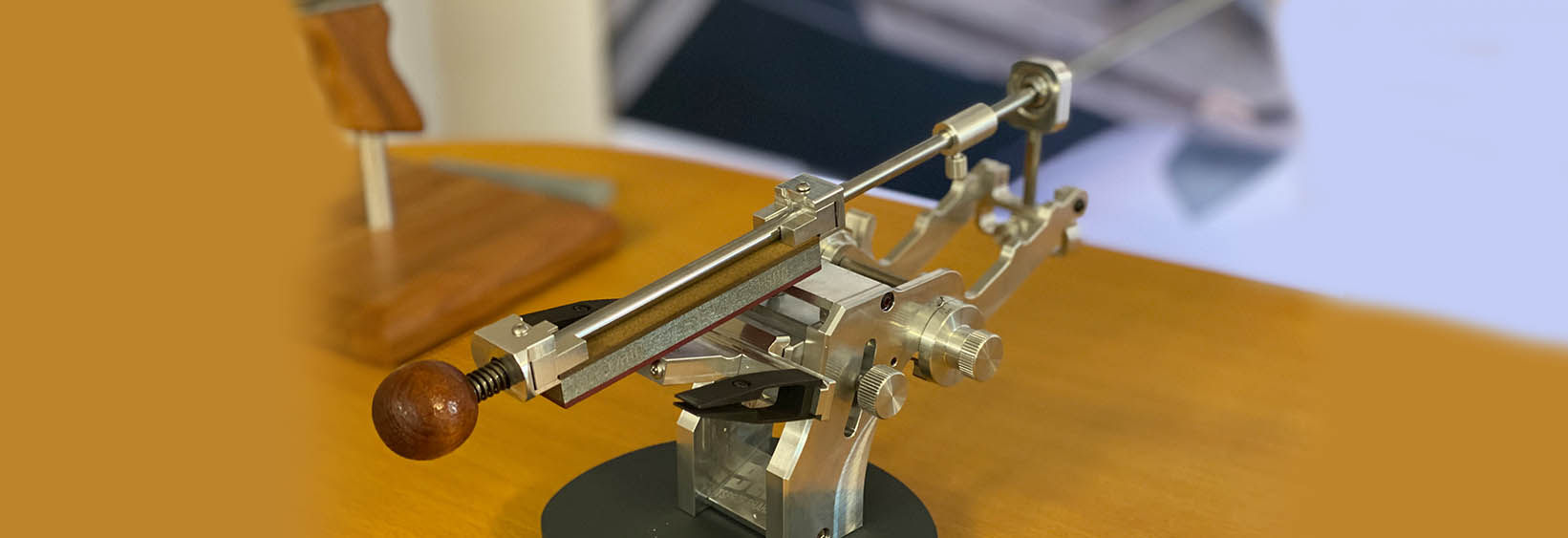

Cin7’s superior support for bundles allows this Russian seller of guided knife-sharpening systems to offer its customers almost endless product combinations.

Read more

Read more

How a quirky, design-driven business found its place in the fashion world using Cin7 to manage a multi-channel, multi-market supply chain.

Read more

Read more

After outgrowing two different software platforms, horror-influenced fashion brand Kreepsville 666 found an inventory management solution that could do everything they needed it to—and more.